Motorcycle Insurance in BC

How much does insurance cost?

We get this question a lot, but the truth is that we don’t actually know. This is because there are many factors which can affect your insurance premium, to the point where two people with the exact same bike could end up paying a completely different amount for their insurance.

While we are unable to provide any specific numbers, you’ll find that your insurance premiums may be affected by any of the following factors:

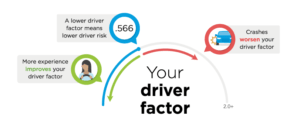

- Driver Factor

- Based on your Driving History or Abstract;

- Includes recorded experience, at-fault accidents, traffic tickets, etc.;

- Insurance & Claims history

- Theft, vandalism, accidents;

- Amount of coverage

- More coverage = More $$;

- Value of bike, deductible;

Specific to motorcycles, the type of usage will not affect your premium (ie. recreation, work, commuting, etc.), however premiums go up with larger engines. Here’s the breakdown:

- Up to 110cc – $

- 111 – 400cc – $$

- 401 – 750cc – $$$

- 751 – 1150cc – $$$$

- Over 1150cc – $$$$$

Types of Insurance

- Mandatory Coverage

- Liability Insurance

- All BC motorists are required by law to have ICBC Basic Autoplan insurance.

- Minimum $200K 3rd Party Liability;

- Many riders elect to purchase more than the minimum amount;

- $1M and $2M of coverage are most popular amongst motorcycle riders;

- 3rd Party Liability does NOT cover you for damages to your own bike.

- ICBC does not offer any further discount beyond your regular Safe Driver discount. More specifically, taking an ICBC-Approved Safety Course does NOT earn you any extra discount for 3rd Party Liability.

- Optional Coverages & Discounts

- Collision/Comprehensive

- If you are interested in protecting your bike against theft, vandalism and accident repair, as well as storage insurance, then Collision/Comprehensive is what you’re looking for. While ICBC offers this coverage at a premium rate, there are many privately-underwritten insurance companies which not only offer this same coverage for a much lower rate. Your rate may also be further discounted if you have a Certificate of Completion from an ICBC-Approved training course such as the one offered at ProRIDE.

- Collectors Status Vehicle Insurance

- Collector status vehicles may also qualify for a reduced insurance rate, provided it is insured for pleasure use only and meets the requirements for this class of vehicle.

- Excess Underinsured Motorist Protection

- This coverage protects you if you are involved in an accident with another party who is underinsured or uninsured. Ask your Autoplan broker about Excess Underinsured Motorist Protection and if it makes sense for you.

We have assembled this list Private Insurers (last checked 2016). If you know of one that is not on this list, please let us know so we can add them in:

Optional Coverage:

- Guardian Risk Managers

- Megson Fitzpatrick Insurance Services

- Beacon Ridesmart by Cansure

- Irwin & Billings Insurance Brokers

- Central Agencies Insurance Brokers

- BCAA